PRNewswire

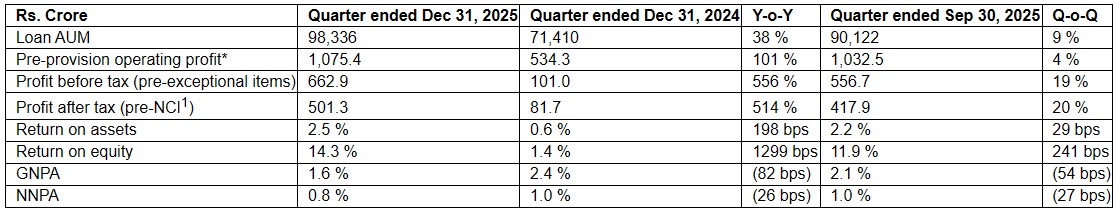

Mumbai (Maharashtra) [India], January 24: Strong rebound continues with PAT at Rs. 501 Cr, up 20% q-o-q.

Significant improvement in asset quality from 2.14% to 1.60%, with exit from high- risk segments, focusing on gold and mortgages.

Interim dividend of Rs. 4 per share (200%) declared and approved by the Board.

For the quarter ended Dec 31, 2025, IIFL Finance reported a consolidated profit after tax of Rs. 501 Cr (pre non-controlling interest) up 20% q-o-q. The company's consolidated AUM rose 9% q-o-q to ₹98,336 Cr, reflecting steady growth driven by strong growth momentum in gold loans business.

IIFL Finance Q3FY26 Results update

Key Highlights

- Gold Loans: Fully normalized post-embargo (Sep 2024); now making up for the highest share in the AUM mix

- Asset Quality: Stage 2/3 trending down; PCR 92%

- Portfolio Re-set: Exited digital unsecured MSME, micro-LAP from HFC & high-risk MFI geographies

- Financial Strength: ROA 2.1% | ROE 11.3% | CRAR (Consolidated, Computed) 27.7% | Liquidity ₹ 9,433 Cr | PAT ₹ 1,193 Cr (9M)

- Growth Focus: Collateral-backed retail lending - Gold, MSME Secured & Home Finance

- Operating Model: AI-led risk and governance systems; phygital reach of ~ 4,800 branches

- S&P Ratings affirmed the rating at 'B+' and revised the outlook on IIFL Finance's Long term Issuer Default Rating from Stable to Positive

- Interim dividend of ₹4 per share (200%) declared and approved by the Board

Mr. Nirmal Jain, Founder & Managing Director, IIFL Finance, said:

"The third quarter reflects a consolidation of IIFL Finance's transformation, marking a clear shift from stabilisation to sustainable operating momentum. Disciplined portfolio re-setting continues to deliver results, with robust loan growth led by gold loans, improved asset quality, and strong capital and liquidity buffers. These gains are also reflected in higher confidence from international rating agencies, as evidenced by recent rating outlook upgrades. With risks well contained and returns improving, the foundation for scalable, high-quality growth is firmly in place. Going forward, our AI-led operating framework, phygital distribution network, and strong risk and compliance discipline will remain central to delivering consistent performance and long-term value creation"

Business Segment Performance

- Home Loans: AUM grew 5% YoY to ₹31,893 Cr but de-grew 0.4% QoQ; business is steady and on track to deliver as per plan

- Gold Loans: AUM surged 189% YoY and 26% QoQ to ₹43,432 Cr, demonstrating a strong momentum supported by healthy tonnage growth and stable asset quality

- MSME Loans: AUM grew 17% YoY and 4% QoQ to ₹10,081 Cr, owing to strategic re-calibration towards low risk secured lending and pullback from unsecured lending

- Microfinance: AUM stood at ₹8,360 Cr, down 19% YoY and flat QoQ, impacted by macroeconomic pressures in unsecured lending

Mr. Kapish Jain, Group Chief Financial Officer, IIFL Finance, said:

"Our Q3 performance reflects the benefits of portfolio rebalancing and tighter execution. Growth was led by gold loans, asset quality continued to improve across businesses, and capital and liquidity remained strong. With cost of funds trending down and provisioning well above regulatory requirements, we are seeing steady improvement in returns while maintaining balance sheet strength."

Revision in Outlook from Stable to Positive by S&P Ratings

S&P Global Ratings ("S&P"), the credit rating agency, has revised the rating Outlook from Stable to Positive and affirmed it's rating as 'B+' long-term and 'B' short-term issuer credit rating of IIFL Finance Limited ("the Company"). Further S&P has also affirmed it's 'B+' long term foreign currency issue rating on the Company's outstanding U.S. dollar denominated senior secured notes.

*excluding net gain/(loss) on fair value changes

1NCI is Non-controlling interest

About IIFL Finance

IIFL Finance Limited, along with its subsidiaries IIFL Home Finance and IIFL Samasta Finance, is a leading retail-focused NBFC offering diversified loan products, including home, gold, MSME, microfinance, and capital market finance. With a network of 4,761 branches and a customer base of over 4.6 million, IIFL leverages a robust phygital model to serve underserved segments across India.

This document may contain certain forward looking statements based on management expectations. Actual results may vary significantly from these forward looking statements. This document does not constitute an offer to buy or sell IIFL products, services or securities. The press release, results and presentation for analysts/press for the quarter and year ended Dec 31, 2025, are available under the 'Financials' section on our website www.iifl.com.

Investor & Media Contact:

Media Relations:

Sourav Mishra

Head of Corporate Communication

Email: sourav.mishra@iifl.com

Investor Relations:

Veenashree Samani

Email: ir@iifl.com

Photo: https://mma.prnewswire.com/media/2868014/Nirmal_Jain_MD_IIFL_Finance.jpg

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PRNewswire. ANI will not be responsible in any way for the content of the same)